“Fire container and rehandling” Detonating the shipping market, international freight forwarders and trade companies are under tremendous pressure

Shipping prices are comparable to cargo values, and It's hard to find a container.These pain points have become a common topic this year in the international shipping market. In the near out-of-control competition in the shipping market, there is also a difference between the joys and the sorrows of several companies.

At present, there is an extreme shortage of ceiling-reaching freight rates and space in the shipping market, maked the international freight forwarders and foreign trade companies under constant pressure.

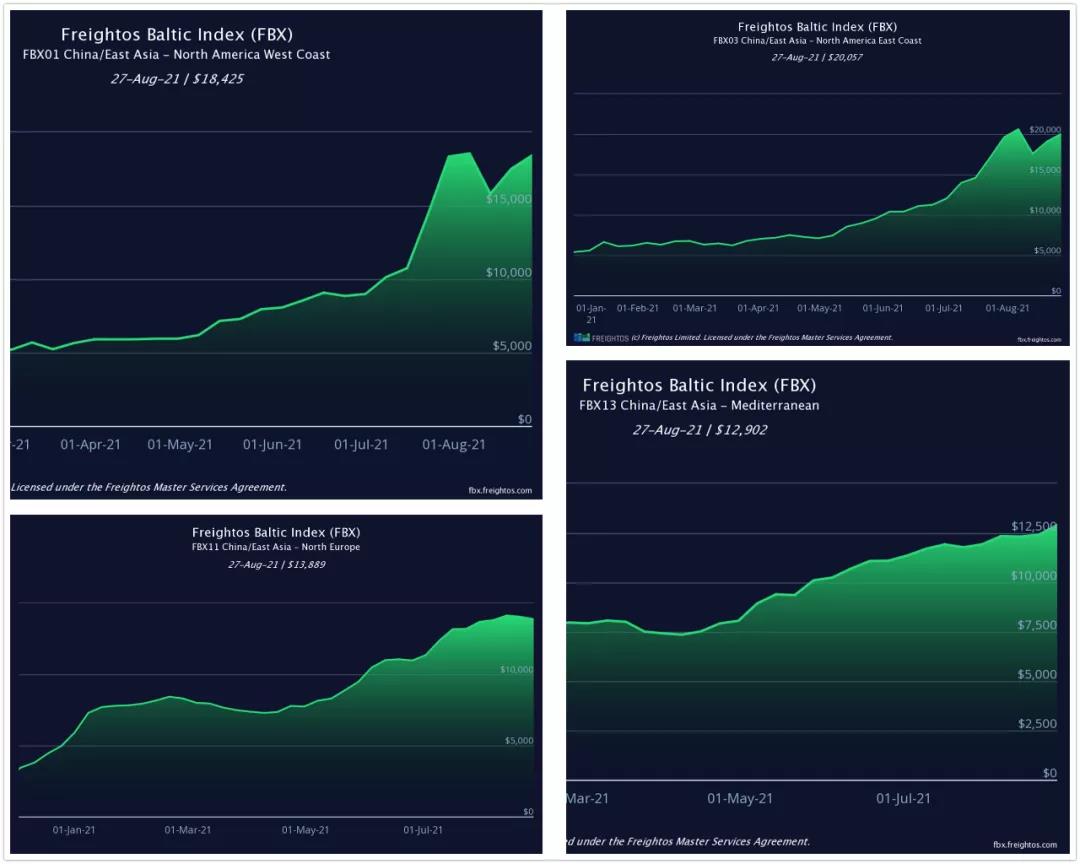

Freight rates on popular routes have increased nearly six times year-on-year

In the world’s popular routes, journalists inquired about Freightos Baltic Index and found that the latest data as of August 27, The previously high shipping price from China/Southeast Asia to the east coast of North America dropped one week later from a high of US$20,636 per FEU (40-foot standard container) in early August, return to $20,000 again. The current price is US$20057 per FEU, 5% increase from last week. The freight rate of the China/Southeast Asia to North American West Coast route has continued to rise after the fall, The freight rate is US$18425 per FEU, an increase of 5% over last week.

The freight rates of the routes from China to Northern Europe and the Mediterranean also started to rise in December last year, and rose again after a slight decline in early April this year. As of August 27, the freight rate for the China-Northern Europe route was US$13,889 per FEU, and the freight rate from China to the Mediterranean was US$12,902 per FEU.

In addition, a query on the official website of the Shanghai Shipping Exchange found that the comprehensive on-time rate index of global trunk routes in July was 18.90%, a year-on-year decrease of 4.44%, which means that the capacity of international routes continues to be insufficient.

The scalper's " Fire container and rehandling " is getting worse

"Currently, the market price of international shipping is soaring, partly because the scalpers continue to ‘fire containers’, The price of the container ship released by the shipping company is not too high, and it has seriously affected livelihoods.” A Shanghai freight forwarding news reporter said. The freight forwarder said, “Some first-generation scalpers who have a good relationship with the shipowner received a large number of boxes and resold them to the second-generation scalpers. After several turnovers between peers, the prices continued to increase. Now the business of reselling boxes is much better than being a freight forwarder.Now freight forwarders like us cannot get the boxes at the normal price, and second, they are willing to pay and may not be able to grab the space. Moreover, there is no chance to see the true face of the shipowner's Lushan, so you can only look at the luck of the shipowner's agent or the peer's resource circle to find out the containers.

In the shipping market, some are happy and some are sad

According to the semi-annual report released by China International Marine Containers Co., Ltd. on the evening of August 27, the net profit attributable to shareholders of listed companies in the first half of the year was 4.297 billion yuan. Year-on-year net loss of 236 million yuan, turning losses into profits. During the reporting period, CIMC's container manufacturing business achieved operating income of RMB 27.451 billion, A year-on-year increase of 224.91%, accounting for the highest proportion of overall operating income, at37.51%. Achieved a net profit of 4.394 billion yuan, an increase of 1739% year-on-year.Gross profit margin was 24.19%, a year-on-year increase of 13.97%.

Compared with foreign trade manufacturers, export orders that are able to grab containers at high prices are often characterized by high value and large demand. And those traditional factories that produce low-value goods can only dying to face the shipping costs of comparable value, and even withdraw from the market. "The long-term delay order makes us freight forwarders really anxious, but we can basically accept what kind of prices will be accepted later, and can't wait. Shanghai freight forwarder said that many foreign trade companies he cooperated with had to accept high costs to go overseas in order to feed workers and maintain factory operations. For some orders with a freight rate comparable to the value of the goods, the factory chooses to resell to the mainland market.

How to alleviate the "high price box worries"?

Recently, Maersk released the latest market information on the supply chain in the Asia-Pacific region in August. The report predicts that container demand in the second half of 2021 will increase by about 2%-4% year-on-year.

According to the latest report issued by Maersk in August, the overall supply of 20-foot dry containers and 40-foot dry containers in China, Vietnam, Cambodia and Indonesia is in short supply. Maersk has invested in the construction of more 40-foot high container containers this summer, and is fully mobilizing empty containers back to Asia. In addition, in order to improve the on-time rate of ships, Maersk will gradually cancel some port calls on certain routes. And launched SOC (shipper's own container) and NOR (cold replacement dry container) services to alleviate the impact of lack of containers